(Article) New Paradigms in Banking

(Article) New Paradigms in Banking

Dr. J. N. Misra introduced the panel members and elucidated that IIBF had sought the views of all banks on the theme under discussion. The feedback received from them was then incorporated in the presentations as discussion points for the distinguished panel for further deliberations

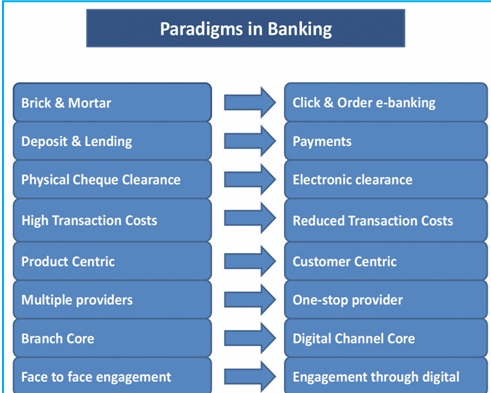

Introducing the theme, Dr. Misra said that the changing face of banking is a reality. From brick and mortar to click and order banking, from deposit and lending to payments, from physical to electronic clearing, etc., the way banking is done has undergone a sea change. How we cope with the changing environment is the challenge before us. How we position ourselves with this change. It is essential that bankers are aware and prepared to handle the change.

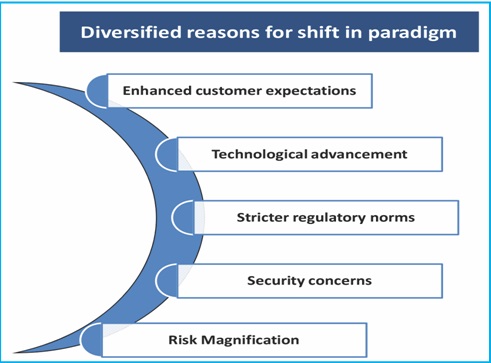

The reasons for the shift in paradigm has been varied and has arisen on account of increasing customer expectation, fillip provided by technological advancements, the delivery procedures have undergone a sea change. There is a need to see how the deliveries can be sharpened, focused and how they are done in the days to come. Stricter regulatory norms have come into the picture. There are a lot of security concerns with the growing use of Information Technology and risk magnification needs to be handled by all bankers.

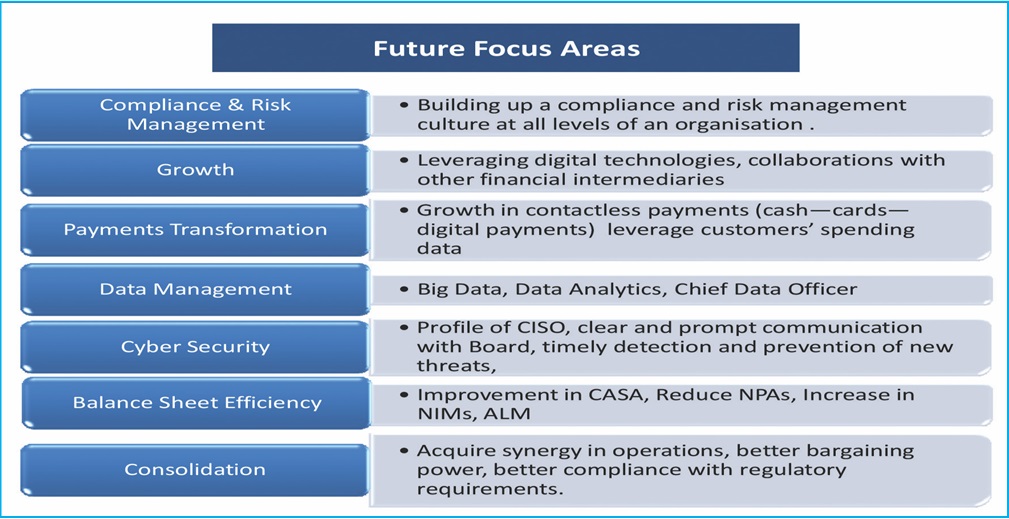

Future focus areas include building up a complaint and risk management culture; leveraging digital technology, how banks will collaborate and role of financial intermediaries; the transformation taking place in the payments space; the large scale changes taking place in data management – big data, data analytics, etc., will become prominent and bankers will have to take full advantage of the tools available

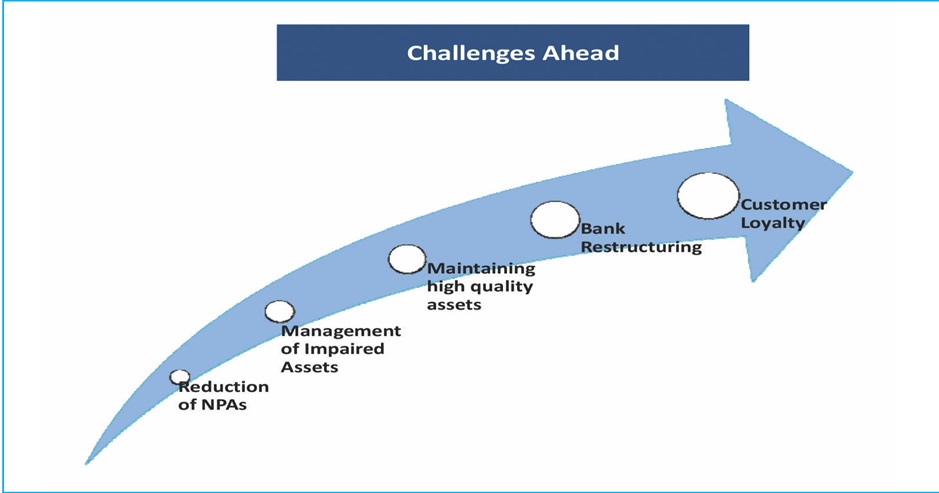

Enumerating the challenges faced by the banking industry, Dr. Misra added, that any change is associated with challenges and it is up to us to face the challenges.

Dr. Misra said that the feedback received from banks on how they are positioning themselves and their thought process have been enumerated. Product innovation has assumed a lot of importance and business process reengineering has been introduced. Robust on-boarding programs for new recruits have assumed significant importance. Data analytics is also a focused area for many banks and they are taking advantage of this. Investment in online marketing and tie-ups with service providers has gained importance. An attempt has been made to include the suggestions of bankers as to how they propose to handle the new environment which they are facing.

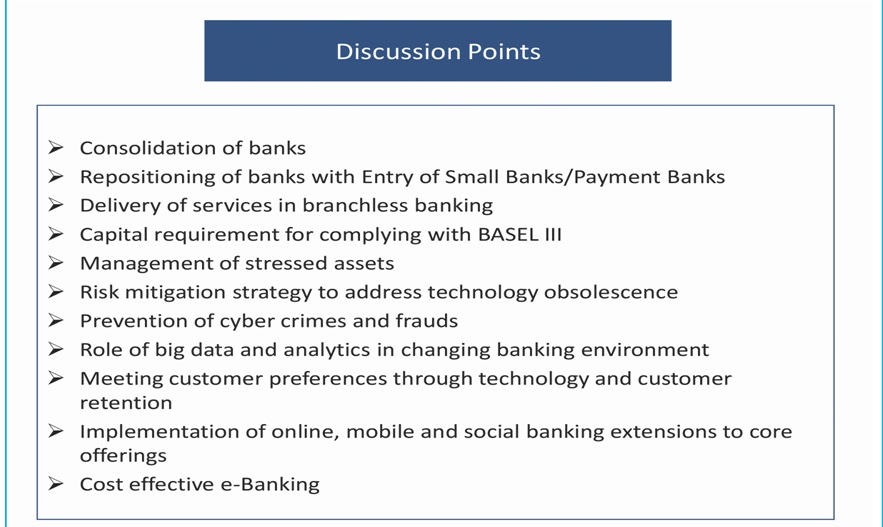

Dr. Misra then drew attention to some discussion points which could be taken up from consideration by the eminent panel. He however said that the essence of the aspects would be left to the panel to discuss.

Mr. Arun Tiwari then set the panel discussion in motion.

Arun Tiwari: There has been talk of consolidation but of late there has been a spate of licences issued for payment banks and small banks. There is a banking paradox here - can payment banks substitute banks? Inspite of the accepted notion that banks may not subsist, banks will continue to play their role maybe in a different perspective?

Sourabh Tripathi

These are exciting times for the banking industry and India is the only country in the world where, in a span of three months, 20 new banks have been introduced in the market. Disruption is the only word to describe the situation.

By definition, payment banks are not allowed to substitute banks and guidelines state that payment banks have to lend in partnership with banks only and not in partnership with NBFCs, so the architectural set up ensures that payment banks work closely with banks to create a full product suite for the customer. The question is -will they really make a difference? Yes, through the very proactive regulatory intervention, RBI has managed to get certain types of unwilling players, the telecom companies, to participate in banking. The telecom companies, with massive presence and large customer base, have the ability to reach people and the ability to have relationship with people in large numbers. This augurs well for the country. It will lead to new type of services, starting with technology driven and branch less banking. Also drawing in customers who are still outside the banking fold. This will also mean competition among them for the digitally savvy customers. The payment banks are also aware that to be financially sustainable, they have to reach out to the high-end customers who are digitally savvy. A recent survey conducted among 3500 customers showed that, only half of the digital banking customers in India were willing to try out the payment banks and only 35% of the customers who did not do digital banking, were willing to try out the new payment banks.

The existing digitally savvy customers will be the first to try the payment banks so there will be a heat and pressure on the new incumbents. The pressure is also on the existing banks to innovate and the next two three years will see a spate of innovative offerings. This will lead to a pressure on profitability and because there is pressure on profitability, there will be consolidation. These are two sides of the same coin:

- consolidate players who do not innovate fast enough and hence feel the pressure;

- introduce fresh blood into the industry to raise the quality.

Arun Tiwari: Any new venture would look at the commercial side also. With payment banks having to maintain 75% SLR and a cap of ` 100,000 deposit, will the new ventures find it profitable or would there be consolidation from the word go?

Sourabh Tripathi

Plain vanilla business is not very attractive for a payment bank. But there is an option value for the telecom companies. There is a huge benefit in the sense that a customer who has taken up the payment bank option will add or reduce their chunk of the business. If they fix a rate of return of 20%, probably 10% will come from the existing customer base and hence, they have to look to achieve a lower target.

With restrictions on partnerships, SLR constraints and only SB Accounts to start with – the new payment banks need to recognise the power of data - they will have the data on where the customer is transacting, payment information as to where the customers are banking, etc. Data is golden and in next 5 years, power of data will increase. It is essential for the service provider to get into a position which enables them to make offers beneficial to the customer and monetise the data. It is likely that the customer may have term deposits with banks, but have SB Accounts with the payment bank and inspite of the limit of ` 100,000, move the transactions to payment banks. If transactions move away, the primary relations move away, the data about the customer moves away and the knowledge of the customer's behaviour moves away. That is the pot of gold, on which the payment banks will base their operations.

Arun Tiwari: Would you look at the licences as an opportunity for the traditional banks?

Rajnish Kumar:

Lot of small value transactions take place in branches, so cost of branch banking is very high. Ultimately, when payment banks come and they partner with banks, it will provide the last mile connectivity. Public Sector Banks have been responding well in introducing new channels and once the payment banks come in, particularly the telecom companies who have a wide reach; using them as Business Correspondents or Customer Service Points can give a lot of advantage. For instance, moving away low value transactions to payment banks or alternate channels. Going forward, the role of branches will undergo a change resulting in a productive gain for the banks by:

- giving value added services at high cost and thereby making it more profitable or,

- providing after sales service for the customer coming to the branch to ensure that they do not migrate to alternate channels.

Partnership and collaboration rather than competition is the way forward. However, payment banks cannot substitute the main bankers especially in the rural and semi urban space, where Public Sector Banks enjoy more trust. Serious money business will be driven by trust, built over a period of time.

The entry of the payment banks is a good development but questions remain over the revenue generation potential of payment banks. The revenue pool is not large and will come down further with competition. In developed countries too, where the banking space is occupied by 6-7 large banks, the new entrants have to make revenue by data mining or cross selling of other products.

Mr. Tyrone Chen then made a presentation on how talent management in banks are also undergoing a change due to the new paradigms. There has been a shift in demand for talents from traditional banking to digital banking. This change is evident even in the attire of the bankers and young bankers are ambitious for change.

Mr. Chen quoted from Brett King on building digital culture "Digital is not a department, channel or separate competency. It is simply the job of the bank and the CEO is the head of digital with a great team behind him that is fully committed. You can have some specialised competencies under this, but if you have a separate head of digital, you aren’t a digital bank, you only have a digital competency within a traditional bank" Mr. Chen added that in Taiwan, special emphasis has been given for the IT training of senior bankers to keep up with the changes. The top management is the guide/ explorer, the middle management developer and the solution providers for the senior executives. Also the branch managers are the professional advisors. The senior executives are the explorers for envisaging new opportunities; promoting changes and incentivising culture of innovation.

At the same time bank also has a functional team –

• being the innovator for designing client experiences creatively;

• leveraging the power of big data to unveil consumer behaviours from emotional, cultural and social aspects and,

• keeping a forward looking perspective on cyber risks and preparing for it.

Regarding sales / service at the branch, Mr. Chen felt that the affluent need branches for increasing knowledge and hence, branches should upgrade and serve the people. Branches should become the advisor for:

• helping clients to get guidance toward adequate services,

• obtain integrated solutions specific to their needs

• take personalized financial advice. Since HR is at the core of transition it is necessary to allocate right people to the right positions and,

• define - professional competency at different functions.

• assess - potentials and gaps of knowledge and skills

• strategize - reallocate and put people in the right place; develop and train for growth; buy in and recruit talents from outside of banking.

Mr. Chen explained how Taiwan Academy of Banking Finance has incorporated Bank 3.0 by:

• blending training with certification to develop and identify high potentials.

• evaluating the adequacy of talent resources at key positions through professional competency assessment.

• partnering with universities to explore and furnish e-banking talents at early stage.

Arun Tiwari: The presentation was lucid explaining the architecture and role of TABF in banking in Taiwan. The power of data. Historically, banking space has been occupied by Public Sector Banks. But, are they capturing the data the way it should be and if they are, are they harnessing the data in the right manner? Looking forward, what is the role of data analytics in the future?

Sourabh Tripathi:

The leading banks in the world are also struggling for cutting edge with data, because technology is moving fast. Banks have made tremendous strides in the last few years, yet the institutions find that they are not able to get all the data that they want, capture all the right information that they want. Problems are the same the world over and not restricted to Public Sector Banks. As regards use of data, we are sitting on the most underutilised data – basically, the banking behaviour of the customer known only to the banks. Going forward, through mobile banking, the bank can even know where the customer is at a particular point of time. The possibilities are limitless. Plain vanilla banking is going to become commoditised.

But at the same time, banks will have pressure to maintain profitability; create value added offerings, in the form of advice to the customer; use data to compare the customer to others like him/her, etc. One side of the coin is that banks are trusted and have the data, so they should use it to further their business and on the other side, with the data available, it is necessary to engage customers and become real partners to the customers in terms of their financial well-being. In this context, he shared the example of Brett King, the author of ‘Bank 3.0’ and the co-founder and CEO of Moven, a New York-based mobile banking startup. The app provides real-time updates for debit card purchases and warns the customer when they have reached their upper limits.

Data analytics provides huge potential for credit. Banks can use the data to give credit. Alibaba is an example of an entity which lends to people totally unrelated to their business but their NPA levels are 1/10th of the banks, thanks to the power of data. Basically, technology is there just to support the usage of data. Therefore, the moot question is not “are we capturing all the data, but are we utilising the data captured?” The answer is an emphatic no. There will be more avenues to come in the future and the banking sector should be prepared for it.

Arun Tiwari: SBI's Intouch, how has been the experience and going forward, what is the role of social media in the banking space?

Rajnish Kumar:

Intouch has been a very good experience for our customers and it is a novelty. Soon, majority of the branches in urban areas will be in the Intouch format. In future, branches have to be designed keeping in mind what type of customers are coming in and Intouch will be popular with the younger generation. In social media banking, there are lot of behaviour patterns which can be captured and which can play a critical role in assessing the needs of the customer - real time, based on their behaviour. Also critical inputs regarding the credit and financial decisions, can come through social media.

Arun Tiwari: Ultimately, when we talk of technology in a service industry like banking, we talk of cost effectiveness and the ease of doing transaction from the customer's point of view. When we talk of consolidation of banks, in respect of banks working on the same platforms in terms of technology, why these facilities should not be consolidated?

Rajnish Kumar:

There are models, like mortgages, where companies provide shared services. Abroad, banks outsource their mortgages. But there are regulations and stringent secrecy laws to be complied with. The customer's sensitive information has to be protected at the bank and, hence, it is very difficult to outsource the core services. But in case of supplementary services like Internet banking applications, mortgage applications, loan servicing/collection, if the systems of the service provider are very strong it can be a very effective model. Some applications have ready platforms like customer service management.

The debate rages on within banks how much to keep within and how much to outsource. Security considerations and confidentiality of data make it necessary for banks to be very careful of the entire system and ensure that there is no data leakage or compromise on the security aspect.

It is a feasible model. But in India, the service provider may be the same for several banks, but the products are customised and it is not possible to create clones. When it comes to consolidation/merger, commonality of key platforms would be a key consideration but will not be a deal breaker.

Sourabh Tripathi:

The consolidation of banks in India has been much talked about but has not really happened. This is because the underlying logic is not clear. The consolidation talks are driven by HR/talent and not by the fundamental issues of banking. Across the world, banks continue to merge and they have different technology platforms, so that is not an issue. In India, the cost of technology is 1/5 to 1/10 of the cost of technology for the banks in the world. So banks in India spend 2-4 % of their revenues in technology whereas the banks in the west spend 15%. Also, the most technologically advanced banks in India have only 1/4 of the number of people that the comparative banks in the world have. It is true that there could be a lot of benefit by sharing technology and cloud based software will be used for many applications in banks in the future and will reduce the cost dramatically.

Another interesting trend noticed in the west is that the banks are increasingly insourcing technology, since technology is the unique competitive advantage. If a bank buys a mobile application from a vendor and other banks also buy the same, the applications will look similar and hence, the new trend is that the lower standardised platforms (core banking solutions) are outsourced but, the applications which are customer facing and applications which are employee facing are kept in-house because that is the source of competition, and it would be advantageous if the bank can change it as and when required and not wait for the vendor to change it.

Banks are, therefore, creating innovation centres where they create an environment where best technology would come. ING Bank Netherlands has recognised that to attract the best talent and give them the best, which the software industry offers, a new environment/ unit would have to be created outside the bank with different HR policies, so that the new talent works in a different and less hierarchical organisation. Banks therefore are progressing towards creating a core team of technologists, who can be the source of differentiation.

Arun Tiwari: Banks in Taiwan - to what extent technology is playing a role in delivering banking services especially in the smaller towns?

Tyrone Chen:

There are 30 banks in Taiwan, which implies ‘over banking’. Consolidation exercises have also not worked with banks unwilling to merge. Therefore, the Govt. made a solution – they created a Credit Information Centre, 40 years ago. Here, the information about the credit availed by the customer is maintained to enable banks to avoid frauds or multiple credit to fraudsters.

Digital banking in Taiwan also faced the same issues as the world over. Small banks did not have the funds to embrace technology in a big way. government therefore established the solutions separately, for instance the ATM Solution Centre, a platform which could be used by small banks and those concentrated in the rural areas. They also established Centralised Information Centre to provide IT solutions to small banks.

Arun Tiwari: Gyan Sangam to Indradhanush – Govt. is talking of consolidation for last 10-15 years. A few mergers have taken place in the past in Public Sector Banks but the Govt. feels that the consolidation should come from the banks and should not be imposed. Consolidation should be based on size or efficiency? Going forward, would there be consolidations or new banks?

Rajnish Kumar:

In Public Sector Banks, all consolidations/mergers in the past have taken place because of the likely failure of the merged bank and have been mooted by RBI. Why should banks merge? Unless that is clear, mergers cannot take place. We need strong banks to cater to the growing needs of the corporates. But the capability of the existing banks to meet their requirements is limited. At the same time, merging a weak bank with a strong bank is not the answer. Again, if ESOP comes, then new questions will emerge - the economic consideration of the merger, whether the value of the shares of the combined entity is going to go up and if it would be in the interest and benefit of both the entities. In India, unless there is a nudge from the Govt., consolidations are not likely to happen voluntarily.

Arun Tiwari: Capital requirements under Basel III was triggered by crisis in US. When the prescription is in place why do we have stringent laws? Capital is needed, but capital to what extent and capital at what cost?

Sourabh Tripathi:

RBI always adds a layer in addition to the international prescriptions. This is because the conservative stance helped India in the recent global crisis. Developing economies like India are riskier, and hence, higher levels are required. In a rapidly growing political environment with multiple pushes and pulls, it is an inherently volatile situation and hence the risks will obviously be high. The higher cushions are likely to hurt the banks but are necessary in view of the higher risks.

Rajnish Kumar:

If we analyse, till 1992, the banking sector was highly regulated, be it credit or interest. Hence, there were no innovations and consequently no credit risk. Inherently, the Indian psyche is to plan for risk. On the negative side, it does not allow innovation. On the other side, innovation in the western world is far ahead. The positive tendency enables us to withstand shocks and the negative stifles innovation.

From looking upto RBI at every stage, banks are now slowly moving towards a phase, where they are developing their own risk framework and working according to a plan. It is true the incomes are under pressure and for banks to provide for loans, they need to look at external factors also, especially macro- economic factors which affect bank credit. There are certain inherent weaknesses in the risk management practices of banks and the management of loan assets weighs in the minds of the regulator when it prescribes higher levels of capital.

Arun Tiwari: There is a contradiction in the prescription of the regulator - SLR is 21.5% and still there is talk about Liquidity Coverage Ratio. Secondly, as per the Basel III requirement, the enhancement in capital requirement needed may be partly funded by Govt. (` 25000 cr.), which may not be sufficient going forward in the next three years. Also, in next five years, Govt. feels that the funds can be raised from the market. Do you feel, once the economy picks up and keeping in mind the kind of money which would be needed for our capital, would the banks be able to generate that?

Rajnish Kumar:

This appears difficult. The banking sector makes money by taking risk and leveraging was one of them. As the Balance Sheet is leveraged and more stringent requirements under capital adequacy frameworks come, the Return on Capital will not be as it was earlier. Internationally, the Return on Capital for banks is between 6-8 % and hence, it is not profitable for banks to approach the markets for capital with such low returns. It is a Catch-22 situation.

For banks in India, raising funds from the market is going to be difficult. This year because of the falling commodity prices, particularly oil and energy, there was headroom available and Govt. could provide for capital but going forward, it is difficult to say if that will always be the case.

Raising capital from the market is going to be difficult unless the profitability increases and profitability cannot improve unless the asset quality improves and the provisioning costs come down. At present, the Return on Assets is around 50 basis points for most Public Sector Banks and Return on Equity not more than 9-10%. In such a situation, going to the market and asking for investments will prove futile, because, who is going to invest at such low rates of return? It means that the task for all the bankers is vast- they need to look at each and every activity from the perspective of Risk Adjusted Return. Banks cannot afford to blindly follow each other and only focus on growing the Balance Sheet. Each and every account should be mapped and should meet atleast the average cost of capital. So, risk adjusted capital has to be equal or more than as of now. But in reality, that is not the situation. This is a concept which is in a developing stage and will need fine tuning. One of the factors has to be adjusted - find the capital for growth or give leverage and have the Balance Sheet size for weighted average of capital assets.

As regards LCR, SLR is very high in India and amongst the highest in the world. With regulatory controls and interest controls on advances, banks have tight liquidity to move around.

Sourabh Tripathi:

Market capitalisation will improve if the market believes. But the market does not believe that the Government will really give autonomy - to talent management and to let the Public Sector Banks be run professionally. If this happens, that is when we will stop worrying about capital and till the Government is not ready to bite the bullet, we will continue to have this perennial worry.

Arun Tiwari: How well capitalised are Taiwanese banks? Are they adequately capitalised or is there a problem of capital adequacy in most of the banks?

Tyrone Chen:

Banks in Taiwan face a severe competition. The spread is very low and hence the banks have to struggle to raise funds from the capital market. Government of Taiwan and the banks are looking at other possibilities and many banks have taken the route of mergers. But there is still a long way to go.

Arun Tiwari: Stress portfolio of assets- in China they pooled all the assets which was capitalised by the Govt. Immediately thereafter, the top four banks entered the market and whatever premium they got from the issue was returned to the Govt. So it was remunerative to the Govt. Can we think of something on similar lines in India?

Sourabh Tripathi:

There is one line of thinking which is against this idea, that there is a moral hazard (the orthodox thinking). They feel unless there is a crisis, this should not be resorted to and should be sorted out by the institution themselves. There is some pressure to see where there is room for improvement, but the orthodox thinking will prevent this idea as being the only idea to solve all the issues.

I feel that we will do it. We will create such a bank, but only part of the assets will move there and not a large amount, which will create a relief. Some of the things will stay in the bank books and banks will have to take care of that. The idea will take time to come to fruition in India and hopefully by the time the idea takes shape, the need for it will be less.

Arun Tiwari: 55-60% of the stressed assets are in stalled projects- roads, ports, steel plants, power plants. Gas was promised - not given, right of way- not given. Even in projects where 80% of the work is completed, there are several issues which crop up. Who is to be blamed in such situations? The pain is more for Public Sector Banks who have to follow the process which will take its own time. ARCs take their time. They have given 15% but, we are yet to see any resolution in last two years. 1.5% management fee is paid every year and at the end of 5 years, the banks will pay out whatever they have given and then the banks are back to square one. Do you feel going forward in a year or two there could be a brighter side for the resolution?

Rajnish Kumar:I hope so. Much of the hopes of the banking industry is being pinned on the new bankruptcy laws which is being talked about and which is likely to be tabled in the Parliament in the coming Session. Creating a bank for recovery will not work unless you have a proper recovery and resolution mechanism. There are reservations about its practicality. When the sectors were opened up in infrastructure particularly power and roads, there were no options but Public Sector Banks had to support. All the DFIs disappeared from the scene. It was also seen as an opportunity for banks and even looking at pricing and interest rate, there were better margins, better upfront fee. When all these loans were given, it was with the expectation of better returns but, many projects ran into difficulty because of environmental issues, encroachments, etc.

But the biggest problem came in the power sector. Core industries like steel have also been financed by banks and they have been a cyclical industry. Unfortunately, they now have a bad cycle which has been much more prolonged. In the power sector, the problems are mostly around the reforms of the Discom. Fuel availability has improved and cost of gas has also come down and Government has given support and has tried to ensure that the tariffs of the gas based plants are almost at par or at the most 20-30% higher than the traditional thermal power sector. If the power sector reforms are to happen and if the Governments (Central and State) are able to tackle the Discoms, that will be a big positive for the power sector. The projects are all good projects and many started in 2010-11 have been commissioned and they will start supplying power soon. PPA is a problem because Discoms don’t have the money, they don’t have money because the transmission and distribution losses are very high. For the power sector, the solution lies in the Discom reform and to add to it in the last three years, no new projects were announced in the thermal sector. So in 2-3 years’ time, the power prices are likely to go up. A project conceived today cannot be commissioned before 2022-23. All these projects which are in the private sector were conceived in 2008-09. Projects got off the ground in 2011 and now in 4-5 years they are ready to be commissioned. There has been some action in renewable energy, but as a percentage of the overall power requirement, their contribution is limited. So that is not going to make a big dent. Ultimately, I am positive for the power sector but we have to wait for one or two years. So the key lies in power sector reforms, faster recovery and resolution where there are effective bankruptcy laws and the working of the Debt Recovery Tribunals. Courts also need to intervene less in these matters. In UK, mortgages are enforced in 15 minutes and decision making is fast. In India, the enforcement of mortgages under SARFEASI takes forever. The bankruptcy law and the functioning of DRT is very crucial. This coupled with the fact that banks need to improve the due diligence process. Lot of improvements in pre-sanction and post sanction monitoring is also required.

The forum was then thrown open to the audience for a Question & Answer session.

Question: Efficiency of the banking system- In India the spread is around 3 %, in Taiwan the spread is around 1.5% and globally, it is around 1%. With ` 25,000 crore needed to meet Basel III, how will the whole yield process look like in the next decade? In the next decade or two, what will be the fate of the large Public Sector Banks with the new technology coming?

Sourabh Tripathi:

To answer the 2nd question first. What will happen to Public Sector Banks once digital banking comes? The latest research shows that only 13% of the people in India use any form of digital banking today. The rate of adoption of digital banking is 2-3 years behind the rate of adoption of online shopping, etc. People don’t adopt digital banking so quickly and so in the next 5-10 years, bank branches are not going to go away. 90% of the people are out of the fold of digital banking and it will be a long journey to bring even 50% of the population under digital banking. Getting rid of branches is therefore not easy.

Even internationally, the branches will remain. May be in different forms. In the banking industry, there is need for human interaction, and therefore need for branches. There are very few markets that are digitised and where everybody feels comfortable to do digital banking. In India, banks like SBI are trying to do many new things on technology, digital banking, etc. The relevance of branches will therefore remain. To answer the first question - in emerging markets, banks have high NIM. Some of the researchers believe that is how it should be. In an emerging market, if the NIM is low, it is an injustice to the banking industry. The risks are higher, the inflation is high, and the interest rates are higher. The high rates of SLR and other requirements force the Indian Banks to operate at higher NIM. We are however nowhere close to where Indonesia is. Indian Banks have a moderate NIM. It should stay that way also because if the NIM is disturbed, the banking industry's ability to innovate and progress will be hampered.

Rajnish Kumar:

As far as distribution network is concerned, establishing a distribution network like SBI has today, is an envy for other players. It is not easy and the role of the branch is definitely going to undergo a change as more and more low value transactions move out of the branch. Although we have a BC model, we will still need a branch where many of the customer service points run by the BCs will be managed. Apart from that, the branch not only does banking but also selling of insurance products, mutual funds, etc. After 5-6 years, perhaps the branches will become the point of cross selling of products. Branches may also become delivery points for the e-commerce sites.

Branch banking has the highest cost per transaction, so the branch has to look at value added services/ advisory services, where they can reduce cost of branch banking. All the channels are likely to co-exist and any new strategy will probably look at an integrated channel: how many brick and mortar branches, ATMs, Internet and Mobile Banking. Earlier it was handled separately, in different silos- branch banking was done by a different department, digital banking by a different department, etc. Now it has to be an integrated approach and for five years atleast, the brick and mortar will continue. The question will be how many brick and mortar branches, what type of business is to be done at these branches and what type of business is to be migrated.

Ultimately, the customer is the king and it is their choice what channel they want to use. Beyond a point, we cannot push the customer to any particular channel. Even today, many customers still prefer branch banking and Public Sector Banks still welcome them and give them service, even if it is high in terms of costs. In several developed economies, the customer has to pay for visiting branches. But we are far away from reaching that stage.

Question: Rigid NPA norms are being followed now. Should we not have region wise NPA norms monitored by RBI instead of having one impractical norm for the entire banking industry, which is affecting not only the bankers but also the entrepreneurs?

Rajnish Kumar:

The 90 days’ norms have been internationally accepted. When an ‘out of order’ account or ‘overdue’ account is identified, internationally it is accepted that it is an NPA account and deviating from that criteria is probably not going to be acceptable and will put a lot of doubt on the credibility of the Indian Banking System and so we have to live with that norm. What is happening in India is that, it is the only norm which we are following for declaring an account as NPA whereas, in any other jurisdiction like, Singapore or USA, the asset classification can be treated as an NPA even if there is servicing of interest and repayment of principal is not in arrears. They look at the fundamental weakness in the account and not only to the account being overdue.

Question: We are talking of the transformation of the brick and mortar branch into the digital branch but who will be the driver for such projects? Where will the talent for operating the new strategies come from? Given that other sectors are better paying. Do you think the stringent regulations laid down by RBI (inspite of the fact that the Indian Banking Industry was not affected by the bubble burst) are because they are unable to control the Banking industry effectively, mainly the people who run away with bank's money?

Arun Tiwari:

Beyond a point it is not the perks, whatever you get as a professional, you earn and slog and what you get, that defines the job a person does. Talking about the talent, IIMs and IITs, although they do not have world class facilities, do give some of the best to the industry as is evident from the fact that many corporations globally are headed by Indians. At the lower level when we talk of the talent in the banking sector - people are ready to come to Public Sector Banks because of the 360 degree exposure that they get in Public Sector Banks. Permanency of jobs is another reason why they prefer to come to Public Sector Banks.

Sourabh Tripathi:

There is a very large workforce in Public Sector Banks who are very dedicated and give their all to their institutions. However, this is not sustainable. When the young generation joins Public Sector Banks, they will not stick around, particularly when twenty new banks are around. The young generation will gain all the experience and go. There is no other way but to open up the HR policy of the Public Sector Banks. In contrast, the Public Sector Banks in many other emerging markets are powerful and also doing very well. The top ranks are appointed by the Government but their salary is not linked to the bureaucrats’ salary.

Rajnish Kumar:

The industry level bank settlements should be done away with. Each bank should have a separate pay structure depending on their own capabilities. Flexibility should be allowed but is possibly not wanted by the Bank Management. Studies show that Public Sector Banks pay better than Private Sector Banks upto scale IV and it is only when one moves up the chain that the remuneration go down. The ratio between the entry level salaries and the salaries of the top management is skewed. At the same time, in developed economies, the difference is extremely skewed. Therefore, the need of the hour is for performance linked incentive.

Question: Banking research is a well-recognised and developed profession in advanced economies. In India, research in banks means economic research. How much banking research are we doing in banks – regarding private/public; foreign exchange/investment banking; behaviour analysis of customer for digital banking, etc. Because technology is moving very fast, unless the financial literacy is improved, there will be human and technological frauds. In advanced economies, they are investing a lot on cyber security. How many banking research institutes do we have in our country? This job should be taken up by IIBF. Atleast the study of the people taking the exams can change the examinations system.

Dr. J N Misra:

IIBF is mainly in the certification area. We do sponsor research but do not have a separate research wing. Going forward, we may have a wing separately. The large banks should ideally be having this Department as part of the innovation centre set-up. This is how it will translate to banking business.

Rajnish Kumar:

To split the question- when we talk of the role of credit in taking credit decisions - for corporate banking, macro-economic research, the research on the specific industry and the client all together become relevant. Where retail banking is concerned, behaviour pattern and analysis of data becomes important and that capability has already been created. Wherever there is mass banking, the role of data is very important, which will speed up the decision making process and that will give confidence to the people taking credit decision or approve using data analytics. This is being introduced in banks and there is a good progress in this direction in many banks.

When we come to development of applications which are customer friendly - there are lot of innovations which can happen from the inside. IT architecture should be such that it provides the necessary flexibility to use the talent pool available in-house. Mr. Arun Tiwari thanked the Panellists and the audience for an interesting and stimulating session.

Courtesy: Dr. J N Misra, CEO, IIBF Panel: Chair: Arun Tiwari, CMD, Union Bank of India; Mr. Rajnish Kumar, MD (Compliance & Risk), State Bank of India; Mr. Saurabh Tripathi, Partner & Director, Boston Consulting Group; Mr. Tyrone Chen, Executive Vice President, Taiwan Academy of Banking & Finance