(Article) Payment Systems - Evolving Paradigms

(Article) Payment Systems - Evolving Paradigms

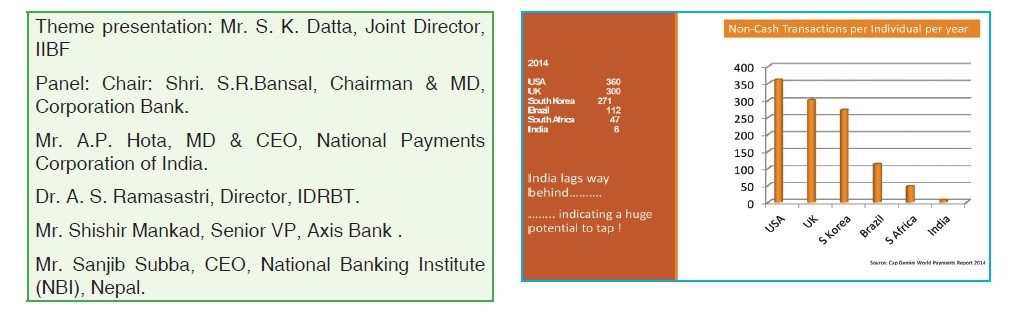

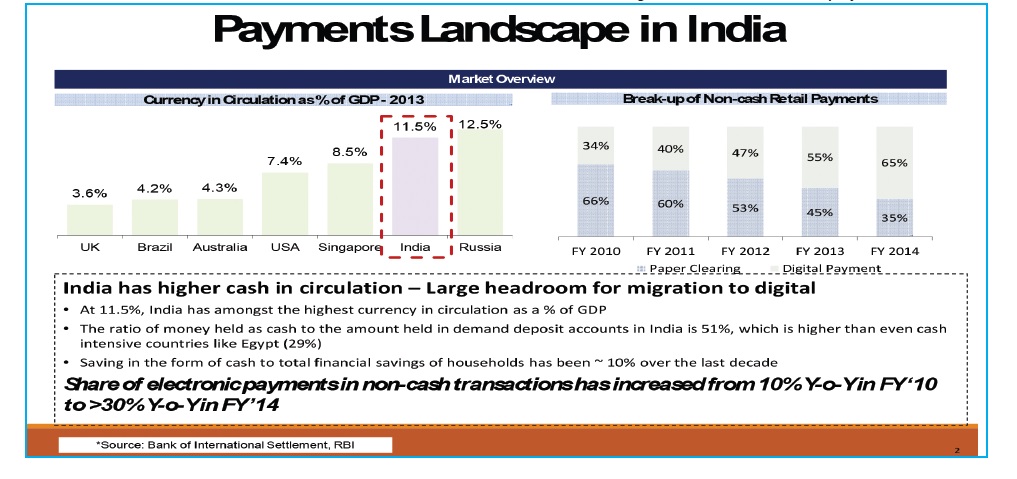

Mr. S. K. Datta introduced the panel members. He highlighted the importance of the theme for speedier financial inclusion. The amount of cash in India is very high and there is a large headroom available for channelling these savings into the banking fold. There is consequently a large scope for increasing the payments volumes. There has also been a large shift in retail payment from paper form to the digital forms. Electronic payments are also

increasing at an increasing pace. Mr. Datta compared the position in India vis-a-vis the other parts of the world. He said that there is a huge scope for electronic transactions. In UK and USA, the no. of non-cash payments per person per year is around 300-360, in India it is just about 6 in India and China.

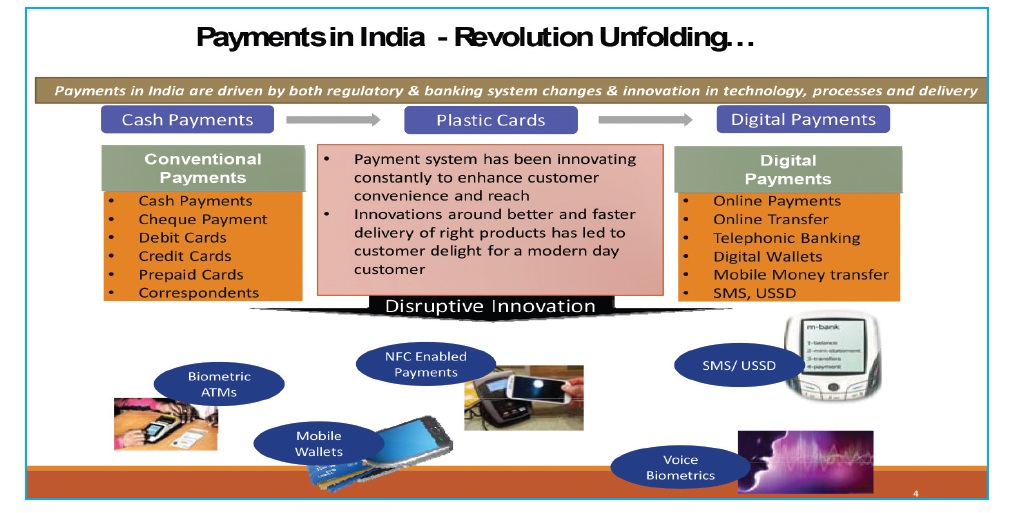

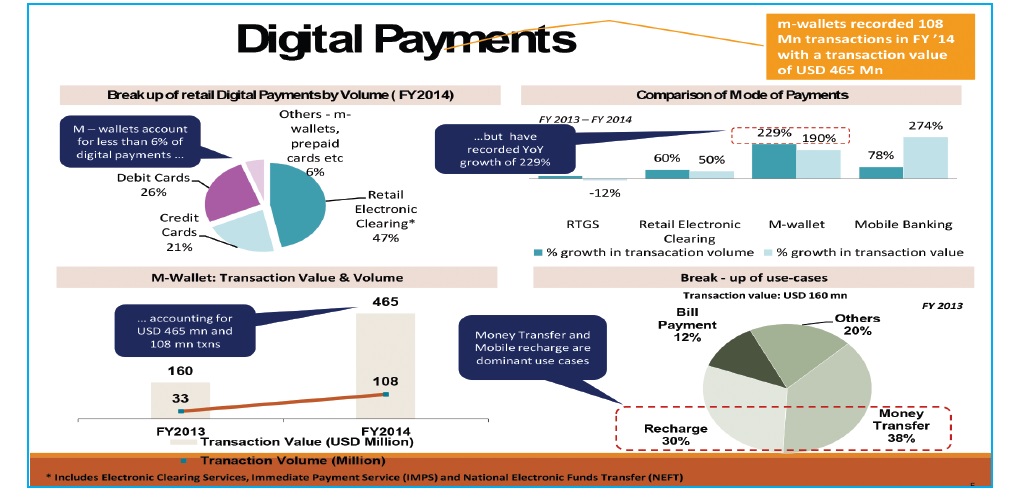

Mr. Datta described the evolution of the payment systems in India, over the years. He also touched upon the disruptive innovations introduced in recent years. Mr. Datta emphasised that it is the wallets which has shown sharp exponential growth both in volumes and amounts.

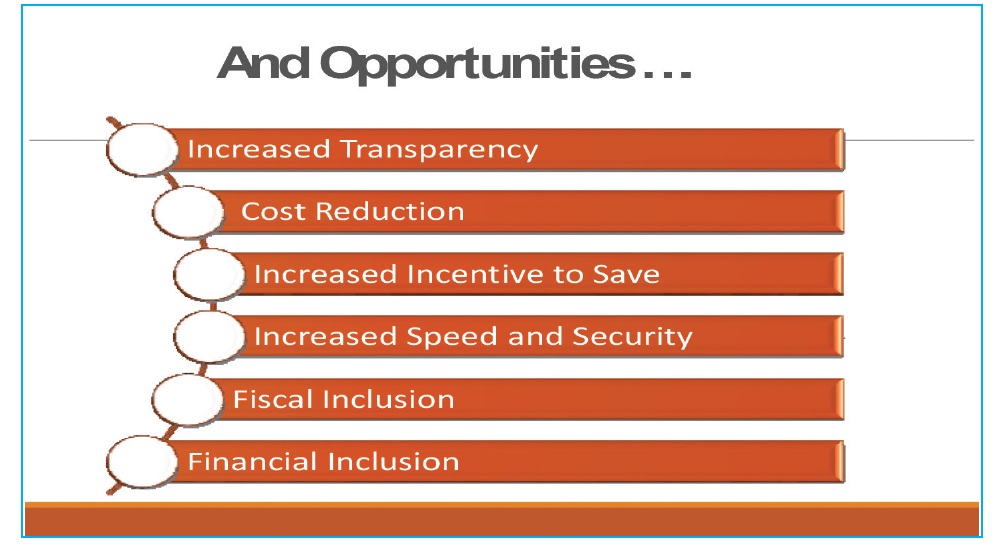

He also listed out the challenges faced by the banking sector both on the demand and supply side.

But, he stressed that there are huge opportunities, which includes not only financial inclusion but also fiscal inclusion, for the banking industry which should be properly tapped.

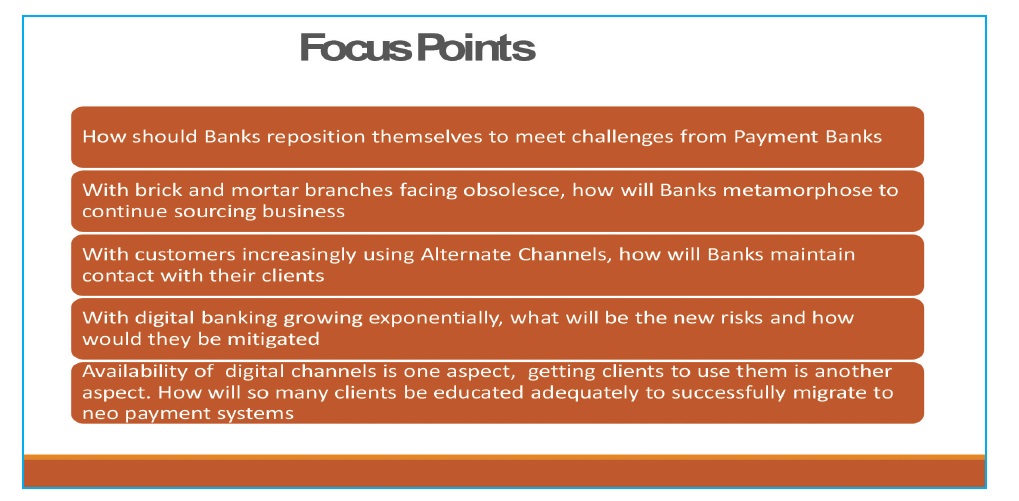

Mr. Datta finally listed the focus points which may be the basis for discussions by the panel.

Mr. S.R.Bansal then set the panel discussion in motion.

S.R.Bansal:

The payment mechanism to bring in more efficiency and transparency in the system is moving from cash to contact less payment to mobile money in India. This evolution has been made possible consequent to a series of measures initiated to contain the systematic risk in Payment & Settlement System. Besides the regulatory push, the Government initiatives such as JAN DHAN YOJANA, DBT, etc. have further given a big fillip to this shift. The emphasis on digital India would further intensify the movement helping to cover more and more numbers of entities and people bringing in speed and ease of making payments. It is in the last 10 years that India has witnessed this major shift from cash based payment to electronic payment system. This was mainly due to various measures taken by Government of India (GOI) and RBI, including introduction of Payment & Settlement Act, the setting up of RTGS and NEFT and of National Payment Corporation of India (NPCI), regulation and promotion of alternate channels and payment gateway and guidelines or security measures for the electronic transactions. This shift has also been increasingly aided by evolution of telecommunication and computing technology, both in terms of speed and reduced costs. While electronic payment system has registered impressive growth, the benefits of the modern electronic payment system are yet to reach many. They are generally now limited to the tier 1 and tier 2 locations. So, the benefit has been limited to those citizens who already have access to formal banking.

The financial inclusion efforts by the GOI in the last few months, have helped in gathering speed in reaching out to the villages. The Aadhar infrastructure has given a significant support to these efforts. Today, we are seeing a transformation of the payment ecosystem not only in retail segments but in all segments such as b2c, b2b, Govt. to citizens and consumers to Govt. At 11.5%, India has almost the highest currency in circulation as a percentage of GDP. This leaves much room for migration from cash, cheque to e-payments. Non cash transactions per individual are very less. 6 per individual

per year as compared to 360 in USA and 300 in UK. Payment through m-wallet and prepaid instruments is less than 6% of the total digital transactions. Also, the population using internet through mobile is expected to touch around 70 crores by 2020 as compared to the current level of 26 crores. It is estimated that internet banking users will grow from the present status of 6 crores to 23 crores by 2020. This type of scenario has posed great challenge to conventional banks to reorient and to reinvent products and processes which have the capabilities to face the challenges of the emerging customer preferences and to retain its prominence in the financial world.

All these developments show the remarkable changes happening in the payment sector, but it is a fact that only those innovations which offer a combination of consumer benefits by way of convenience, speed, reduced cost and error free settlements would only survive. The entry of new payment banks and new players will definitely increase the competition in the industry. It is evident to all of us that, those who have got the in-principle for payment banks have platforms for assessing the customer base, have infrastructure, expertise, technology and also adequate capital base. We must prepare ourselves, to take on these challenges and to be more innovative so that we not only match the products and services that are on the offering from the new players but also meet the growing requirements of the customers. Banks may also explore possibility of tie-ups with these entities so that it can be a win-win situation.

S R Bansal invited the panel members to share their thoughts on how banks should position themselves to meet the challenges from payment banks.

A.P. Hota:

I would like to elaborate on the payment system in India, for the benefit of the international delegates. During the last 10 years, the payment landscape in India has undergone a metamorphosis. All possible advanced payment systems that can be thought of are available in India now. The traditional mode of clearing has also been modernised in the form of cheque truncation system. The older ways of salary, dividend and pension has come to a new platform- the ACH. Mobile banking has come up in a big way. Although the number has

not picked up, it has been put in place. The country has developed a card brand of its own. All the 200,000+ ATMs have been made interactive. The number of PoS terminals is impressive, but not good enough. E-commerce has gone up in a big way almost 30-35% increase YoY growth and the indications are that it will grow significantly. Although many changes have taken place, there are a lot of things to do.

It is in the wisdom of RBI that new set of institutions which are focused on payments, dedicated for payments, should be there to further two purpose – financial inclusion and innovations in payments. Obviously, the first response of the banks will be – what is that was lacking that the payment banks have now come? Payment banks will have a few disruptive innovations. Some of the new payment banks are coming with a card payment acquiring business which is totally different from the traditional ones. They are coming out with PoS terminals which can be discarded if they are defective – low value, low amount. Banks so far have not gone for that. So the first response is whether to compete with them or co-operate with them. Of the 11 new players, there are 3-4 players who have tied up with the banks, which is a good move. For instance, SBI- Reliance. Reliance is thinking of installing 2 million PoS terminals.

The telecom companies and the banks have been having differences on which convergence could not be arrived yet. Now they are coming to the banking stream and they would be part of the banking infrastructure and the USSD infrastructure. They were running the USSD and now will be part of the banking system. It is good that they are now coming as payment banks and with banks accepting them, the interoperability would be at all levels. Now USSD is interoperable, but interoperable to the advantage of the telecom companies’ and to the disadvantage of banks. Once the telecom companies become banks, possibly things would be different. They have a direct connect with the customers by having large outlets. They can access deposit faster. It is a good thing for the country, for the customers, and banks if they can leverage. Banks need not see them as competitors but as partners. In their mandate, they can act as the BCs of other banks. So why not utilise the mandate instead of competing.

RBI’s vision to bring the new set of institutions is to fill the gap and to meet the need for bringing innovations in the payment system. An example of disruptive innovation

-When WhatsApp replaced the SMS – similarly in the payment space, if a new player has the WhatsApp attitude, atleast, the micro payments can be brought to the table by the new banks. This will be good for the customer and the country. Banks should leverage and not look upon them as competitors. Way back in 1996-97 the PSBs had thought that with the entry of Private Sector Banks, the business would be eroded. This however did not happen. PSBs have really prospered along with the growth of the Pvt. Sector. Now the payment banks- the initial perception would be a threat and if they can really work out /respond to it in a positive framework, it would be a win-win situation for both.

S. R. Bansal: So many disruptions coming in, it is not a threat or competition but a partnership.

A. S. Ramasastri:

Traditionally, we understand banks which take deposits to lend. But the main focus of the payment banks is not lending; they are not expected to lend. They will be occupying the other space, i.e., payments. Traditionally, most of the payments were either cash based or non- cash based. All non-cash based payments were routed through the banks. So, banks came more and more into the payment space. Once the payment space came to the banks, they were expected to give more features to the customers so that they will be able to do the transactions more comfortably. Three important features that a customer looks for – cost, convenience, control over the transaction at any point of time. Banks were expected to do this and have been doing it quite well.

During the last 4-5 years, different kinds of payment systems came to be introduced. We started with RBI setting up the RTGS, NEFT, etc. but they were central bank managed. Slowly, the movement has moved from a central bank managing the payment system to various private parties and others. It is happening across the globe. When the payment systems across the globe were studied, in the developed countries, the private parties were driving the payments including on the digital platforms. In other countries like Kenya, it is not the private sector but the entire ecosystem that drove the need for change. In India, it is neither the model of the developed countries nor the model of the other countries like Kenya. Banks were therefore, not able to enter the space fully. Digital wallets and other things are being introduced but these have limited usages. It is in this context that RBI thought that It might be right to come up with a system of banks which will be exclusively devoting themselves to payments. What are the challenges that the banks might face when these payment banks come?

- because of their reach, they can collect deposits also, is there a challenge to existing commercial banks

– deposits which they were earlier enjoying is possibly going to go to payment banks.

- most of the payments that the merchant banks and others are doing is going to move to the payment banks and most of it is going to be managed by them.

This is a challenge. Because the payment banks are those which already have the kind of technology that is required to provide low cost high convenience and lot of control over the system. Mobile penetration is very high in India. Mobile companies - are they in a better position to provide this payment mechanism? Another thing is postal officials, who have a good reach across places, especially in villages where they are friendly with the locals, whether they will be able to come and deliver the services, which are actually required for the people? This is another challenge the banks may have.

But what are the challenges to the payment banks? Looking at the whole space, despite the efforts of the regulator, Govt. and the banks, why did we not take steps to encourage people to participate in the technology payments. It has not happened. When the new banks come, they also have to address this issue and identify the gaps. The major issues identified have been lack of awareness, lack of education, both formal and informal by the bank staff. Most important is the trust. Encouraging people to use the new technology and ensuring them that the systems are safe is going to be the immediate priority. Are the people going to believe that if they send a transaction through this mechanism, it will work? How will their trust be built in the system? If they are able to bring them into the fold then it will be a good thing, because more people will come into the banking fold using the payment space and the new products and certainly the banks will also take advantage and the whole combination will work for the country as a whole.

The next 2-3 years when the payment banks begin operations will be an exciting period for the country and we have to see how the payment scenario will undergo a complete change in the country. Also disruptive technologies are good but are they good for a country like India where we are spread out. Having diverse participants may not always help disruptive technologies.

S R Bansal: There are two things –

- there may be threat for deposits, but through JAN DHAN YOJANA, we have experience of reaching out to the rural masses and creating faith. We have also shown that JAN DHAN YOJANA is profitable. The BCs are working and if we make them more active, we can meet the challenge of the deposits going away and

- cash will be replaced by non-cash and therefore, banks will have more space to do some more business.

Shishir Mankad:

In Wells Fargo, Chicago, they talk of the history of Wells Fargo – how they started as a carriage business – logistics company carrying mails from place A to place B and that mail became a bill and that bill became money and Wells Fargo became a bank. That Wells Fargo of

200 years ago is unrecognisable from the Wells Fargo of today, which is a very technology intensive, very astute, very diversified institution. Much the same degree of transformation is looming large upon the Indian banking system and for good reason too.

There are two ways at which banks can look at with payment banks coming in – the first response is agility. Conceptually, payment bank is a focused business on primarily one line of activity which is payments and therefore, banks which are a conglomerate of financial business, have to compete against this focused nimble player. So, the first response should be agility. Banks will have to decompose the banking business as seen in the digital part of the banking business. Banks have to figure out how to become agile. While the payment banks will have wallets, the unsung fact is that massive growth in mobile apps has been seen at the banks. We are seeing a revolution within today’s banking systems. The challenge for banks is going to be how we create the internal framework to allow for that agility to foster and grow so that we can take the payment banks head on. That is a competitive way of responding to the issue.

Another way is back to basics strategy. Fundamentally, banks provide the five financial needs of the consumer – save, invest, borrow, Insure and transact. Banks should think very carefully about where their real competencies lie, what are those things that differentiate them from the payment banks, and build/augment business on those lines. This is a very fitting response strategy. If the two are put together – agility and back to basics – it comes to a situation where, in some places banks will compete and in some other places, they will collaborate. In short, it can lead to co-opetition (co-operative competition). We will need to figure out where we will compete with them, compete hard and build the capabilities. But there are enough places to collaborate and we can feed off the innovation and the markets that they open. Basically, banking is a flow business and the more the flows that are created and the bigger networks that are set up, everybody in the system benefits. We need to figure out what are the spaces that will get opened up when the payment banks come and feed off them. We need to think why inspite of so much intervention, we still regret and lament on the relative progress of financial inclusion. It comes down to the basics that the bank is supposed to offer, trust, reliability, convenience, fairness, etc. The basic tenets still remain and banks, payment banks, network institutions need to sit and solve for financial inclusion to take off. The question why the customer is not using the pre-existing infrastructure still remains centre stage.

Sanjib Subba:

I would like to share some perspective from Nepal – what we are experimenting with branchless banking, in terms of leveraging technology when it comes to banking. Nepal banking landscape is very new. The private banking has a 30 years’ history but a large chunk of the private banking has been around only in the last 10-15 years. Nepal went directly to CBS system. Most of the Nepali bankers have not worked in the manual system unlike their Indian counterparts. It is an advantage, but the size of our banks is small. The largest bank in Nepal has not more than 150 branches and 100+ ATMs. The country total is 1650 ATMs. But the banking industry has not looked at the ATMs as sales and considers the ATM as a value added product. Per day transaction hit has to be atleast 275-280 to break even for an ATM. No ATM gives a break even in Nepal even from the ROI perspective. The gap between the debit card and total deposit accounts is almost 8 million. Against 13 million deposit accounts, 4 million debit cards have been issued.

There is a lot of customer orientation, education and cross-selling skills of the lower level and frontline staff has to be carried out at a large scale to address the issues. In the last 4-5 years, we started experimenting with branchless banking and online banking and even mobile banking without much success. People still prefer brick and mortar, they would like to come to branches and there has not been much success. The no. of branchless banking transactions works out to one transaction per customer in a year, which is very low.

In Nepal, the currency in circulation is around 16% of the GDP. The society likes to feel the cash and is not comfortable with plastic money. Access to finance – we should re-term as access to form of finance. From my perspective, there is a huge difference. Our markets in the emerging markets are informal and challenge is to bring in this informal financing to the formal financing sector. In terms of disruptive technology, going forward, in payment systems, be it RTGS etc., the transitions will be fast and quick. The young generation in Nepal is technically savvy. The big question is will we have the bank in this structure in 20-30 years, what is the disruptive technology that will come and compel the bank to change the structure? Will the bank convert to payment banks or will the telco’s using the smartphone, by bringing the cost down, be able to take away a large chunk of the bank’s overhead? The technology investment by telco’s- will it help balance the spread? Will it reduce the cost of funds?

S R Bansal: You have the advantage of directly being on the CBS platform and techno savvy young country. There are not much barriers for your country.

Whenever I travel, even in smaller villages I find Axis Bank. They have been able to penetrate into rural India and into areas where others fear to tread. With brick and mortar branches facing obsolescence, how will the banks metamorphose to continue sourcing business and also with customers’ increasingly using alternative delivery channels, how will banks maintain contact with the clients?

Shishir Mankad

Axis Bank sees a long time ahead for the brick and mortar branch and do not foresee branch’s obsolescence. Fundamentally, that is the assumption we are making. It is accepted that the role of the branch is changing and changing rapidly and putting lot of demands on the bankers to figure out what is to be done. But the branches are an integral part of the Axis Bank’s offering to our customers’ – be it retail, corporate or Govt. What changes are we seeing in the work profile as we go forward. Clearly, routine transactions are plateauing even reducing in some urban areas. There are three roles for branches –

1. Advisory- customers still need to come to banks for advice. There are moments of truth where they have to make large decisions, maybe mortgage, investment, large deposit, insurance. For large decisions, they need some advice and branches are well positioned to deliver on this front. There are remote channels where this can be delivered but branches have an important role to play in this and it will likely continue to be so.

2. Issue resolution- customers sometimes have issues to be solved and there again, the branches will continue to have a big role to play.

3. Accelerating and evangelising the digital channels. Axis bank has 1500 cash deposit machines which are self-service devices for customers to deposit cash.

Almost like a teller. Initially, customers were hesitant to use the machines, and obviously they needed assistance to use them. For some time, assisted models to help customers to move to digital platforms will be an important part of the branch model. This is not new. Even when the ATMs were introduced, the bankers had to assist the customers in the operation of the card in an ATM machine.

The size of the branches is however coming down, since the work culture is changing and we are evolving the model continuously.

How do banks maintain contact with their clients in the digital world – digitally. But how is it to be done?

1. To integrate contact-ability as a fundamental part of on-boarding. A challenge is integrating contact- ability has legacy issues. Keeping pace with the change

of address, mobile phone nos., is a challenge. No requirement for customers to update this info with the branches. Bank is trying to integrate contact-ability in every transaction, every account opening, every on- boarding. Some of these are needed for OTP, etc. But fundamentally, the contact-ability is needed to on-board a customer to a transaction. This ensures that bank is in touch with the customer.

2- With lot of data infrastructure coming into the picture, a Pan card is not necessary. Only the number is required, which can then validate data from the NSDL sites. CIBIL has got good coverage. Social media has good uses, particularly for lending. Looking at ways to contact customers on digital social media channel or using data infrastructure is also a big step forward. Banks have started doing this and can do a lot more in this direction.

3- The digital model allows the flexibility to segment the customer much better. Where there is a commercial opportunity at the higher end, personal and physical contact will still be reached out. At the other end, where there is risk perceived, banks may try to reach out in such cases too. These are easier in a digital world. S R Bansal: In a country like India, the brick and mortar branches may not go away in the near future. In digital banking, in a country like India, where the majority is in rural areas, faith is very important. To create faith, we have to see that risks associated are mitigated. IDRBT are doing a lot of things in this area. With digital banking growing exponentially, what will be the new risks and how will they be mitigated?

A S Ramasastri:

The customer looks for cost, convenience, control, confidence. Confidence/trust comes out of the security which is there in the overall system especially in the case of banking, because money is involved in that. Today, people still have trust in the bank and deposit money in banks. In fact, the whole thing (money) is in digital form. So, comfort level has been achieved. When we talk of payments, and banking though a gadget available with him, either mobile banking or internet banking – the customer has still not developed the confidence. This confidence can come if the banks are able to build a system and convince the customer that these systems are safe and secure. How to convince the customer? How to build a secure system? When the entire IT system is within the premises, in the control of the bank, what are being used are gadgets, which are not meant for this secured system – internet and mobiles – the primary uses of these systems were something different. But we are using them for banking now. This bridging is difficult. On one side, banks have to work at building a secure system and secondly, convince people that the systems are secure.

The issues are slightly different – I get confidence in a system if I keep doing transactions and I don’t find much of a problem after I do it for a fairly long period. It is only then that confidence comes or I am very sure that redressal mechanism is exceedingly good – if a transaction is not taking place, I get redressal very fast and the right kind of redressal. If these are to happen, the entire ecosystem should know about this. Today’s problem is that the bank staff does not know the digital banking system. If at all a fraud/crime takes place in the digital banking channel, do we have an ecosystem which is legal to address the system and give redressal to the customer. This is also not clear in today’s circumstances.

By building these digital systems, i.e., the anytime anywhere banking, adequate security needs to be built into it, ensure that it is monitored and ensure that it is working well and if something goes wrong, there are people with adequate knowledge to understand and bring it back to normalcy. Institutes should focus on security and its importance – security labs, mobile security labs which actually looks into these apps and are able to say whether the systems are reasonably safe. But there are many more things which have to be done for digital banking to succeed.

When we talk of payment systems, we should be able to distinguish between high end systems which are large value, systemically important and where the security levels are very high. But when it comes to customer convenience, there cannot be too much security, but there should be adequate controls to ensure that the losses are minimised and also that reversals are possible in case of losses. So if the system is to be convenient, it cannot be too strong. And if the system is not strong, trust is not possible to be built. So we have to try for affordable security solutions on small gadgets like mobiles, internet, etc. Many of the features are built in but the message should go that they are reasonably secure.

From the angle of technology and risk, it is scary and should be taken care of by the IT team and the banks and not the customers. Customer should have the awareness only. The internal strengths have to be really good. Those who are using the system should be given adequate comfort that the systems are working well.

S R Bansal: All systems are highly secure only that it should be continuously monitored. In India, the number of mobiles is more than the population excluding children and senior citizens. How important is mobile payment in the years ahead? When we see rural India, there is a lot of requirement for education/literacy. So how do we avail the digital channels and get clients to use them? How will so many clients be educated and successfully migrate to the new payment systems?

A P Hota:

Mobile payment is going to play a very significant role in future. Even in the western world, mobile banking is not very popular. We talk of Kenya, Bangladesh, Afghanistan- few countries where it has been extremely popular and they have become very dominant systems in the payments area. In India, it started in 2010 and when it started, it started with a system of immediate money transfer, instant payment from any mobile no. to any mobile no. which is tagged to the bank account. Mobile banking over the last 4-4 ½ years has undergone significant changes.

Inspite of the efforts of the regulator, the banks and the Govt., compared to the premise that we have that 900 million phones and active phones in the range of 650 million, the no. of transaction is hardly around 35 million. It is not significant in terms of numbers but significant in terms of policy that we as a country are growing at 8%. If it continues for a few years, if the e-commerce continues, if the economy grows in all aspects, the kind of transactions that would happen would be phenomenal. Would it all happen in cash? Would we continue to pay 85% of the bills by cash? Would we continue to pay all the shopping experience by cash? Would the banking system be able to handle so much of cash? Even at small places, the demand for cash deposit machines is growing – depositing the cash at the bank in a small town is still a challenge.

Handling of cash would be a challenge for the banks, would be a challenge for the regulator. Here, we are talking of cash to GDP of 11%. If the growth rate goes up, the kind of cash generated would be phenomenal. So we have to move to non-cash system. Which is the most non-cash system that we can think of? Which is the low cost non-cash electronic payment system? It is mobile. That is why mobile has to be the focus. After the Jan Dhan Yojana, the JAM (Jan Aadhar Mobile) has come - how the three can be combined – Aadhar as the authentication, mobile as the device, and the account holders. All the prepaid users have opted for the wallets and the success of the wallets has been driven by the large discounts offered for the users. That is not sustainable. The sustainable method is one which will drive on its own. Mobile has to be made popular.

There has to be a delicate balance between security and convenience. So far, convenience is the issue. The mobile payment system in India is secure enough. It is so secure that people are not transacting. Of 85 banks and 11 PPIs, only 9 banks are doing SMS based financial transactions, because of the fear. This fear has to go. RBI has already relaxed the two factor authentication for EMV based card payment transactions. Atleast, we should consider if the m-pin can be waived for a low value transaction? Say ` 200.00 for payments at the local grocers. If the payments are made by SMS, how can it be made simple and convenient? The best solution is contact-less. Contactless – the work is on, but till then, the SMS based system without a pin transaction is also required. Data driven security and analytics driven authentication- instead of every time asking for the pin, can at the back end, an analytics be generated/ transaction stopped - something needs to worked out.

The programmes of the telecom companies should be more user friendly. More secure platforms have to come and that only can revolutionise payments. Also, the interchange and the aspects of interchange have to be addressed. If the mobile banking transactions goes the way of the traditional card based interchange, it will not work. Currently, mobile based merchant payments are equivalent to card interchange. Which is why mobile based merchant payments have not started.

Financial literacy: without literacy all the good things that are being discussed cannot happen and it is possible if it is taken up on a war footing. Literacy should not only be for the people, but also for the bankers and stakeholders. A drive similar to the efforts taken to open accounts is absolutely necessary for literacy, so that people are made more aware.

S R Bansal: Fear has to go and faith has to be created. What is the average transactions in ATMs in Nepal?

Sanjib Subba:

Average hits range from 60-150 per day. As banks and regulators, we should focus particularly that the payment system is at the BoP model – base of the pyramid, i.e., where the large chunks of the volumes are taking place day in and day out. The Government payments and collections, pensions and provident funds which comprise a huge portion of the fiscal channel, if that can be through digital channels, it will take care of the non- cash. In Nepal, it is still in discussion stage and has not yet been formalised. This is a transitional economy and transitional process and bankers will have to really gear up in their risk assessment process.

Question: An interesting point was SMS based banking where we can have a pre-set limit. Whether we can create a database of pre allowed people where the initial due diligence takes place and all are registered and set limits. For these people, these kind of transactions can be allowed. That will free up a huge area. Once the due diligence is done on a small base, in one–two years’ time, the numbers will grow.

A P Hota

It is worth trying out. Meanwhile NPCI and banks are working on a unified payments interface. In this, we are trying to simplify certain things which may be for relatively larger values also. In the card payment system, the card is what one owns and what one knows is the four-digit pin. Now we are working out whether we can do two factor authentication at a single click. In a mobile transaction, if the mobile as a device, is authenticated as a onetime measure and if subsequent transactions are done at a click, especially low value payments; authentication

may be required only for higher value payments. This is an experimentation which is being carried out under the guidance of Mr. Nandan Nilekani, Innovation Advisor for payments. We also experimented with USSD in bKash in Bangladesh – 4 million transactions a day. In our interbank system, we generate hardly 1 million a day on the USSD platform. Why has it succeeded there and not succeeded here? Some restrictions were imposed by the telecom companies on the banking system and it has also been indicated to TRAI. Hopefully, the issues will be sorted out in the next few months and we will be able to move on the USSD platform.

Question: You mentioned about making the small payments to the local grocer, washer man, vegetable vendor can be made through electronic means. We tried to do this using buddy and the challenge faced – the payer and the receiver both need to have the data connection on their mobile phones which entails a cost.

2nd- since the communication happens through the internet, there are two levels of communication– at the authentication stage and payment stage - and depending on the reliability and availability of the communication; it takes its own time. Every transaction takes between three to five minutes to perform. Nobody is going to wait for that long, especially for small value transactions. Compare that to making that same payment in cash. The whole transaction is over in 30 seconds. NFC as a local means of communication is going to take time. Can we think of other means of communication? One means of communication could be SMS, which again entails a cost. Can we use Bluetooth which is available on all the devices? But for that the payment applications need to be interoperable. And for all payment operations to be interoperable, it is necessary that the payment operations should be sponsored by a national agency like NPCI.

A P Hota:

Making payment across may be easy but the best mechanism is contact less. Contact less takes away the technology from the person. It is the way to go and we have to find how we can do it. Contactless technology is already available with visa and master card. For a large country to move forward, it is ideal to have our own national contact less platform. The national common mobility card which has recently come into play is an example. This can transform the face to face ordinary payments. The speed has to match the agility displayed by the grocer in accepting cash. An equivalent of cash has to be brought in electronic form.

Question: Referring to the World Bank report on migration and remittances, there is a lot of internal migration within the country in India. Internal migrants transfer money but there is no data on that. Is NPCI tracking that?

A P Hota:

An interesting study was conducted by NABARD and GIZ, regarding remittance corridor in India. Another challenge to the bankers - an RRB in a village which is doing very well, but money cannot be sent to the bank directly. Can the RRB be brought under IMPS? How to enable all the RRBs’ and all the Co-operative banks on the IMPS platform? If the banks do not respond to this, the payment banks will take away this business too.

Mr. S R Bansal thanked the panellists and the audience for an interesting and stimulating session.

Courtesy: Mr. S. K. Datta, Joint Director, IIBF; Shri. S.R.Bansal, Chairman & MD, Corporation Bank.; Mr. A.P. Hota, MD & CEO, National Payments Corporation of India ;Dr. A. S. Ramasastri, Director, IDRBT; Mr. Shishir Mankad, Senior VP, Axis Bank ; Mr. Sanjib Subba, CEO, National Banking Institute (NBI), Nepal.