(Jobs) Recruitment of Financial Literacy Counselor at PNB - 2016

(Jobs) Recruitment of Financial Literacy Counselor at PNB - 2016

For Bijnor, Uttar Pradesh

The broad objective of the FLCs will be to provide free financial literacy/education and credit counseling. The specific objectives of the FLCs are given as under:

Post Name: Financial Literacy Counselor

Functions /Activities to be undertaken by FLCs:

- Credit Counselling

- Debt Settlement

- Customers’ Rights

- Mechanism for Credit Counseling and Debt Settlement

Eligibility:

(i) Preferably individual retired as Bank officer with

experience of handling credit and having worked in rural / semi-urban area.

(ii) He should have been Honorably retired from the Bank. He should be able to

work independently and should have computer knowledge, especially of programme

like MS Word, Power Point, Excel and should be

able to operate internet.

(iii) His age on the date of engagement should not be more than 62 years.

(iv) Initial engagement of the Counsellor shall be for three years subject to

review on yearly basis with one year extension subject to production of medical

certificate of good health from CMO. The extension will be subject

to upper limit of 65 years.

TERMS AND CONDITIONS:

i) Counsellor is to be paid fixed monthly remuneration which has been revised w.e.f. 01.01.2016. The existing and revised remuneration of FLC Counsellor is given here under: Location of FLC Existing remuneration Revised Remuneration w.e.f. 01.01.2016 :

- Metro 20000

- Urban 20000

- Semi Urban 15000

- Rural 15000

ii) He will be entitled to only one day leave per month on non-cumulative basis. Any leave availed more than this, would be treated as leave on loss of pay

Qualification and Training of Counselors:

- As FLCs are expected to play a crucial role in assisting and guiding the distressed individual-borrowers, it is necessary that only well qualified /trained counselors are selected to man the centre on a full time basis. The FLCs could consider engaging people with domain knowledge in agriculture for counseling related to agriculture and allied activities.

- Individuals such as retired bank officers, ex-servicemen, etc., may be allowed to be engaged, among others, as credit counselors.

- Credit counselors should have sound knowledge of banking, law, finance, requisite communication and team building skills, etc.

- Proper training and skill up gradation is essential for the counsellors to keep themselves abreast of the latest developments in the banking industry. Training would be to be provided through RBI’s College of Agriculture Banking (CAB), Pune or Bankers’ Institute of Rural Development, Lucknow in coordination with PSLB Division, Head Office/Financial Inclusion Division, HO/Central Staff College, Delhi.

- The Financial Literacy Counselor / Director heading the Financial Literacy Centre is the key stakeholder in driving the financial literacy initiatives at the ground level. Some of the points / modalities to be kept in mind for engagement of Financial Literacy Counselors in FLCs are as under:

a) The qualification and the knowledge/skills of the FLC Counselor in

conducting camps.

b) Prior Experience in banking/related fields.

c) Working knowledge of computers.

d) Knowledge of the local language.

e) Maximum Age of FLC Counselors.

f) Fixed Remuneration at market rates with incentives for better performance.

Procedure for Selection

(i) Short listed candidates be called for interview by the

Circle Head.

(ii) Selection to be finalized by the Committee of three persons headed by

Circle Head (DGM / AGM). LDM can be taken as second member and third

member may be Outsider (Principal of any reputed management /educational

institute.

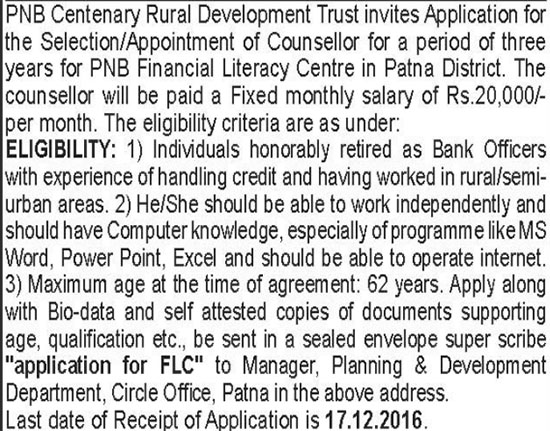

For Patna

Click Here for Official Notification

Courtesy: PNB