NSE Academy: Post Graduate Certificate Programme in Banking and Financial Services

NSE Academy: Post Graduate Certificate Programme in Banking and Financial Services

Q1. Why a Post Graduate Certificate Programme in Banking & Financial Services from NSE Academy?

The Indian banking industry is an INR. 64 trillion (US$ 1.17 trillion) market and by current growth rate it will be the third largest in the world by 2025. The domestic banking industry is set for an exponential growth for more than 20% in coming years with its assets size poised to touch USD 28,500 billion by the turn of the 2025. Since April 2014, the Reserve Bank of India (RBI) has granted 23 banking licences to new players (2 for universal, 11 for payments banks and 10 for small finance banks). Under the Pradhan Mantri Jan Dhan Yojna, 22.81 crores new accounts have been opened to facilitate financial inclusion.

Retail banking will be immensely benefited from the Indian demographic dividend. Mobile and internet banking will see one of the fastest growth. Mortgages will grow fast and are likely to cross Rs 40 trillion by 2020. There is a requirement of at least 40,000–50,000 additional branches and 160,000–190,000 additional ATMs in the coming decade.

The National Skill Development Corporation has predicted that BFSI (Banking, Financial Services and Insurance) will require 42 lakh professionals by 2022. Further as per report from FICCI and Boston Consulting, the banking industry will need to hire massive 9-11 lakh employees over the next five years and By 2018, the banking industry is expected to generate around 7.5 lakh jobs. Banking industry alone will overtake IT as the leading job creator by 2018.

Though banking is one of the fastest sector of job creation, yet there is very high shortage of skilled manpower. National Stock Exchange (NSE) being 3rd world’s largest stock exchange is taking proactive steps to prepare competent breed of professionals for skills required for Banking and Financial Services (BFS) industry through NSE Academy Ltd. (a subsidiary of NSE). This is done by launching a full time, Post Graduate Certificate Programme in Banking & Financial Services (PGCPBFS). The programme will commence from 18th Oct, 2016 at Delhi and Mumbai.

Q2. I want to know about, full time, PGCP- Banking & Financial Services.

The PGCP (BFS) is designed jointly by experts from NSE Academy and Banking and Financial Services Industry to fulfil the skill gaps in BFSI. The PGCP-BFS is an 11 months, full time programme divided into 3 trimesters. In addition to the prestigious PGCP-BFS from NSE Academy, participants will also receive banking and financial services industry regulatory/recognized certificates from Indian Institute of Banking & Finance (IIBF) and National Institute of Securities Markets (NISM) and Insurance Regulatory and Development Authority of India (IRDA).

The emphasis is on experiential learning through simulators, banking software, seminars, presentations, workshops, industry visits, case studies, individual and group assignments, research project, project report, e-learning etc. to make you market ready on completion of the programme.

Q3. What are the salient features of this programme?

1. Programme is directly offered by NSE Academy

2. BFSI Industry regulatory/recognized certifications

3. Hands on experience on Banking industry simulator/software

4. Programme offered at centrally located place at Delhi & Mumbai

5. Experiential learning, industry mentors, case studies etc.

6. Faculty – seasoned bankers, industry experts & academicians

7. Practical skills development needed by industry

8. Job ready from the 1st day

9. Multiple career options in Banks and Financial Services industry

Q4. Why should I join this Programme?

As per the survey report by Indian Bank Association, (Indian Banking 2020: Making the Decade’s Promises Come True) BFS is the most preferred sector (33%) by graduate and post graduates. Massive recruitment drive is taking place in banks. Security of job, decent salary, other perks including soft loans, esteem in society, good career, etc have all contributed to this new found attraction into banking industry.

Generally the employers are reluctant in taking fresh candidates as they do not possess relevant skills. The PGCP-BFS programme from NSE academy not only provides knowledge and skills but also makes you competent to acquire relevant industry and regulatory certificates which are a precondition or preferred qualification. This sets you apart from the crowd and makes you job ready from day one for the banking and financial services industry.

Q5. What is the programme coverage?

The PGCP-BFS is a full time 11 months, 3 trimester programme. Each Trimester will have 10 papers.

Trimester I – Foundation for Banking & Financial Services

1. BFS-101 Introduction to Banking and Financial Services

2. BFS-102 Quantitative techniques for Banking & Financial Services

3. BFS-103 Introduction to Financial Planning & Wealth Management

4. BFS-104 Depository Operations

5. BFS-105 Mutual Funds

6. BFS -106 Retirement Advisory Services

7. BFS-107 Life/General & Health Insurance

8. BFS-108 Finacle (Finance, CIF, Customer Accounts)

9. BFS-109 Project / Emerging Issues in BFSI, MDP/Seminar

10.BFS-110 Workshop - Business and Digital Communication

Trimester II – Banking Products and Services

1. BFS-201 Principles & Practices of Banking

2. BFS-202 Banking Products and Services

3. BFS-203 Accounting and Finance for Bankers

4. BFS-204 Regulatory Aspects of Banking

5. BFS-205 Home Loan – Practice & Procedure

6. BFS-206 Home Loan Advisory Services

7. BFS-207 Financial Advisory Services

8. BFS-208 Finacle (Overdraft, limit node, collateral, loans)

9. BFS-209 Project / Emerging Issues in BFSI, MDP/Seminar

10.BFS-210 Workshop - Human Relations Skills

Trimester III – Banking Specialisation

1. BFS-301 Digital Banking

2. BFS-302 Marketing of Banking and Financial Services

3. BFS-303 KYC, and Anti Money Laundering

4. BFS-304 General Elective* 1

5. BFS-305 Specialisation Elective# 1

6. BFS-306 Specialisation Elective# 2

7. BFS-307 Specialisation Elective# 3

8. BFS-308 Finacle (Payments and Trade Finance)

9. BFS-309 Project / Emerging Issues in BFSI, MDP/Seminar

10.BFS-310 Workshop - Personal Grooming and Branding

* General Electives (any 1 for paper code BFS-304)

- Retail Banking

- Corporate Banking

- Cyber Crimes & Fraud Management

- Trade Finance

# Specialisation (any 1, with 2/3 electives for paper codes BFS-305, 306 & 307)

- Credit Management

- International Banking & Finance

- Treasury Investment & Risk Management

- Regulatory Compliances in Banks

- Banking Technology

Banking and Financial markets are dynamic in nature. NSE Academy reserves the right to change, drop or add any of the papers which in its opinion will best serve the interest of students

Q6. What is the Programme schedule?

The classes for PGCP-BFS will commence from 18th Oct, 2016. The Trimester wise schedule of academic sessions is given below.

- I 18th Oct, 2016 – 3rd Feb, 2017

- II 6th Feb, 2017 – 26th May, 2017

- III 29th May, 2017 – 17th Sept 2017

Q7. Is PGCP-BFS inclusive of Industry certificates?

One of the core strength of PGCP-GFM is to make you employment ready from the day one by including regulatory/industry recognised certification examinations from NISM, IRDA/III and IIBF. Many of these certificates are regulatory/industry recognized and is a necessary precondition for the employment in banks and financial services companies. Certificates of IIBF also provide an opportunity for better pay by way of advance increment(s) at the time of employment.

Q8. What career opportunities are available on completion of PGCP-BFS?

The PGCP-BFS will provide multiple career opportunities in public sector banks, private sector banks, NABARD, RBI, NBFCs, Financial Services companies, Credit Rating Agencies, Investment banking industry, Insurance Sector, financial intermediaries etc .

The entry to public sector banks is generally through examination conducted by IBPS (Institute of Banking Selection and Personnel). The future career progression in public sector banks is as below:

Junior Management Grade – Scale I: Probationary Officer

Middle Management Grade – Scale II: Manager

Middle Management Grade – Scale III: Senior Manager

Senior Management Grade – Scale IV: Chief Manager

Senior Management Grade Scale V: Assistant General Manager

Top Management Grade Scale VI: Deputy General Manager

Top Management Grade Scale VII: General Manager

The career in private sector banks start as Officer, Assistant Manager, Deputy Manager, Manager, Senior Manager etc. depending upon your background qualification etc. Some of the illustrative roles /profiles in private sector banks are given below:

- Banker

- Wealth Manager

- Back Office Operations

- Relationship Managers

- Loan Officers

- Bank Tellers (Cashier)

- Credit Manager

- Investment Bankers

- Risk Manager

- Audit manager

- Financial Service representatives

- Insurance Advisor

- Trade Manager, etc

As you progress in your career you can move to senior positions e.g. AVP, Deputy VP, VP-Senior, VP-Executive, VP-President etc. The PGCP-BFS will provide you with a professional edge compared to your peers to make a career in banking industry.

Q9. Does NSE Academy assist in placements?

NSE Academy will provide placement assistance to successful candidates but do not guarantee any placement

Q10. What is the status of PGCP-BFS?

PGCP-BFS is India’s first programme with regulatory/industry recognised certificates from banking and financial services industry. It is clarified that PGCPGFM is neither a degree nor a diploma and is not recognized either by AICTE or UGC. It is an autonomous Post Graduate Certificate Programme directly offered by NSE Academy to develop regulatory and industry skills required by the BFSI.

Q11. Will NSE Academy assist in PG accommodation?

If required by the students, NSE Academy will assist students in finding suitable PG accommodation.

Q12. What are the eligibility criteria for admission to PGCP-BFS?

- Graduations from a recognised Indian University with consistent 50% marks and above in X, XII and Graduation.

- Graduation should be in regular class room mode without any drop/gap.

- Maximum age limit is 25 years as on 18th Oct, 2016.

Q13. What is the pattern of NBAT exam for PGCP-BFS?

NSE Aptitude Test for Banking and Financial Services (NBAT) will be held from Sep1, to 13th Oct, 2016, on every Thursday at NSE office in Delhi and Mumbai. The NBAT will be objective type, paper based test to judge the aptitude of the candidate for Banking and Financial Services (BFS) sector. The NBAT will be of 1 hour duration with negative marking of 0.25% mark for incorrect answer. There is no prescribed syllabus but the pattern will be similar to Banking examinations focusing on:

- Verbal Ability (30%),

- Data Interpretation and logical reasoning (30%),

- Quantitative Aptitude (30%),

- General Knowledge of Banking & Financial Services (10%).

Q14. What is the selection procedure for admission to PGCP-BFS?

The admission to the programme will be based on NBAT, a psychometric test and interview. Graduates from Indian recognised universities with consistent 50% marks in class X, XII and Graduation can come for counselling cum admission session to NSE office in Delhi or Mumbai. An informative counselling session will be held for all such candidates who register for the counselling session on or before Wednesday of every week starting from 1st Sept, 2016.

After the counselling session, interested candidates can submit the application in the prescribed form (given at the end of this FAQ) along with the fees of Rs.500/- by cash or DD (no cheque will be accepted). The counselling cum admission session is a day long process and candidates are advised to be mentally prepared to complete the process on the same day from 9:30am to 5pm. All applicants will go through the admission process thereafter.

Such counselling cum admission sessions will be held on 7 Thursdays on Sep 1, 8, 15, 22 & 29 and Oct 6 and 13, 2016. The schedule of counselling cum admission session is given below:

1 Registration for Counselling 09:30am to 10:00am

2 Counselling Session 10:00am to 10:45am

3 Application & Registration for the Test 10:45am to 11:00am

4 NSE Aptitude Test for Banking and Financial Services (NBAT) 11:00am to 01:00pm

5 Psychometric Test

6 Interview 02:00pm to 04:00pm

7 Declaration of Result By 05:00pm

Please note that the admissions to PGCP-BFS will be based on eligibility and first cum first served basis. Once the seats are filled, NSE Academy reserves the right to close admissions early without waiting for the last date of 13th Oct, 2016.

Candidates shortlisted for admission will be given 3 days’ time to deposit the registration amount of Rs.15,000/- to block their seats. Please note that registration amount once paid is not refundable under any circumstances.

Q15. If selected, which documents do I need to submit and when?

The onus to check the eligibility for admission is on the candidate, at the time of registration, you are required to submit a copy of following documents and bring originals at the time of admission for verification.

- 10th, 12th, Graduation Mark sheet

- Birth Certificate

- Resume Copy

- Application Form

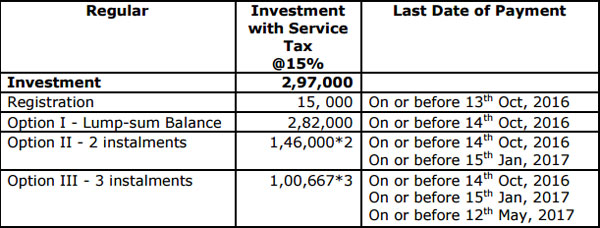

Q16. What is the total investment for PGCP-BFS?

The total investment is Rs.2,97,000/- inclusive of Service Tax (Rupees two Lakh ninety seven thousand only) for the programme. The rate of service tax w.e.f from 1 st June, 2016 is 15% (14.5%+Agricultural Cess).

The investment for the programme is inclusive of cost of study material, tuition fees, service tax (@14.5%+ 0.5% Agriculture cess) and market simulation lab, The investment is also inclusive of one time examination fees for 10-15 industry recognised certificates offered in the Programme. The expenses not specifically mentioned in FAQ, if any, will be borne by the candidate(s).

Q17. Am I eligible for education loan facility?

The students selected for admission can avail education loan from Credila (an HDFC Limited company) which is our education loan partner. Details will be provided to interested candidate(s).

Q18. If I need any further clarification, whom can I contact?

In case you need any further assistance you may send query to bfsdelhi@nse.co.in or bfsmumbai@nse.co.in depending upon place where you want to study. Alternatively, you may contact the education counsellors at 2 of the NSE offices as per address given below:

DELHI

National Stock Exchange of India Ltd.,

4th Floor, Jeevan Vihar Building,

Parliament Street, New Delhi-110 001

Meenakshi: 09582230057

Nivya: 09891059033

MUMBAI

National Stock Exchange of India Ltd.,

6th floor, Kohinoor City, Tower – 1,

Commercial – II, Kirol Road, Off. L. B. S.

Marg, Kurla (W), Mumbai – 400 070

Priti Gupta: 08425999989

Courtesy: NSE Academy