Current Affairs For Bank, IBPS Exams - 17 July, 2015

Current Affairs for BANK, IBPS Exams

17 July 2015

:: National ::

Arvind Panagariya to head panel on caste data

-

Amid the delay in release of caste data collected by the states under the Socio-Economic and Caste Census (SECC), 2011, the Cabinet on Thursday approved setting up of an expert group headed by Niti Aayog vice-chairman Arvind Panagariya to classify the data and publicise it.

-

However, no time line has been set for release of the data on caste/tribe as most of the states are yet to submit their report to the Centre on clubbing of various sub-groups of castes.

-

States have yet to complete the consolidation of 46 lakh castes,sub- castes,sub-caste names, synonyms, surnames, clan and gothra names enumerated by the census.

-

Other members of the Panagariya committee would be nominated by the ministries of social justice & empowerment and tribal affairs.

-

The Centre’s move comes after opposition parties demanded release of the caste data immediately.

-

The government has already released the socio-economic data generated by SECC on rural areas on July 3. It showed that almost 75% of households earn less than R5,000 per month; nearly 60% of them are deprived in some way or the other; 56% are landless and close to 36% of the rural people are illiterate even 68 years after independence.

:: Business ::

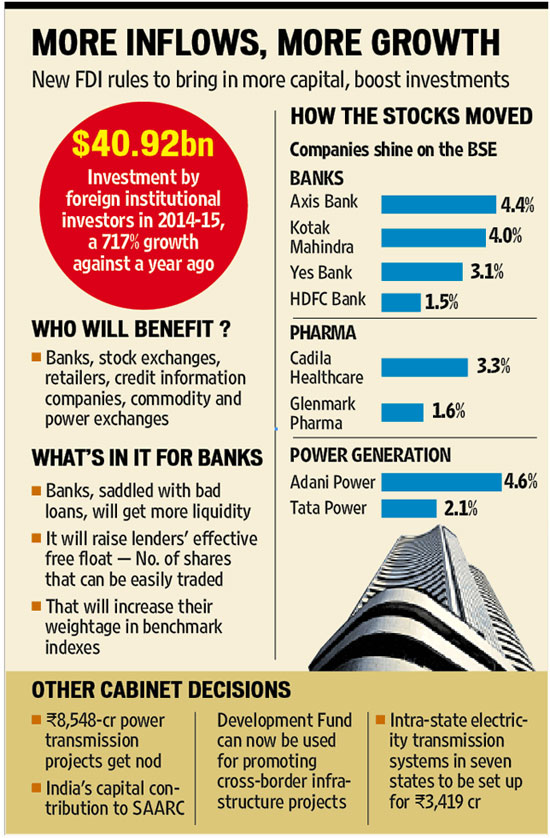

Centre eases foreign investment rules, banks likely to gain most

-

In a move that will attract more overseas inflows and improve the ease of doing business in India, the government on Thursday simplified foreign investment rules by bringing together different categories.

-

The Cabinet Committee of Economic Affairs (CCEA), chaired by Prime Minister Narendra Modi, introduced a composite cap for all kinds of overseas inflows, including foreign direct investment (FDI), foreign portfolio investment (FPI) and investments by non-resident Indians (NRIs).

-

The decision, which was first announced by finance minister Arun Jaitley in the Budget, boosted stocks of banks, which will now find it easier to attract foreign capital up to 74%. Banks are already reeling under the pressure of rising bad loans and need billions of dollars to meet capital requirements.

-

Besides banks, credit information firms, commodity and power exchanges, and defence and other retail companies among others, will also benefit from the policy.

-

The policy will allow any sort of foreign investment up to 49% without government nod, i.e., through the automatic route. However, investments that are subject to government approval will continue to come under the Centre’s purview. The same will apply to sectors which allow 49% FDI. In case of companies seeking to rejig their portfolio of investors within the 49% cap, it can be done through the automatic route, except in banking and defence, where the FPI limit has been capped at 49% and 24%, respectively, subject to government nod.

RBI norms to push more loans to farmers

-

In a bid to strengthen credit flow to small and marginal farmers, the Reserve Bank of India (RBI) has asked banks to ensure that direct lending to such farmers does not fall below the average of the last three years for the whole banking system.

-

The central bank will publish this average number at the start of every year, it said in a notification. This is in addition to the changes in priority sector lending norms that the RBI made in April this year. These changes in norms come in the wake of the Centre’s concerns over an uncertain monsoon and its impact on small and marginal farmers, the RBI said.

-

The RBI had widened the scope of PSL by bringing in loans to medium enterprises, social infrastructure and renewable energy under the ambit and removing the bifurcation of direct and indirect lending to agriculture.

-

The central bank also raised the target for direct lending to small and marginal farmers under the norms to 7% for 2015-16 and to 8% for 2016-17. In its Thursday notification, the RBI added that banks should also continue to maintain all efforts to reach the level of 13.5% direct lending to the beneficiaries who earlier constituted the direct agriculture sector.

RBI tightens NPA rule on credit card dues

-

Labelling a credit card customer as a non-performing asset just became more easier for banks with the Reserve Bank of India tightening norms on dues.

-

The RBI has asked banks to consider the due date on which the customer is supposed to pay the minimum amount towards credit card dues while calculating the 90-day period beyond which the customer will be considered an NPA if there is no payment made.

-

Earlier, banks took the date of the next billing statement while calculating the 90-day period.

-

The RBI said these measures would ensure greater ‘credit discipline’ among borrowers. Credit card issuances have risen sharply in recent times with the increase in online shopping thanks to e-commerce boom.

-

According to RBI data, banks issued more than 1,78,000 credit cards in April and the outstanding credit cards issued went up to 2.12 crore. As of May end, credit card outstanding amounted to R32,400 crore, a growth of 23% year-on-year.

:: Sports ::

Neeraj Kumar appointed chief security advisor for ICC World T20 2016

-

Former Delhi Police Commissioner Neeraj Kumar was appointed as the Chief Advisor of Security and anti corruption unit (ACSU) of BCCI for next year’s T20 World Cup to be hosted by India.

-

Kumar was already roped in by the BCCI for a one-year period in the anti-corruption unit during the IPL.

-

Amrit Mathur has been appointed as the Principal Coordinator while R P Shah will be the Tournament Manager, Finance.

Mohammad Hafeez banned from bowling for 12 months

-

Pakistan all-rounder Mohammad Hafeez has been banned from bowling for 12 months after his action was found to be illegal for the second time since November, the International Cricket Council (ICC) said on Friday.

-

Former Pakistan captain Hafeez was initially reported after the first Test against New Zealand in Abu Dhabi in November and was subsequently banned after an independent analysis found his action to be illegal.

-

He was cleared to bowl in April after changing his action but the part-time off-spinner was again reported by match officials for a suspect action during last month’s Test against Sri Lanka in Galle.